If you cannot see the graphic or access the links within this message please go to the source

|

|

Not as good as gold but just maybe as safe as houses

The history books may one day show that the early months of 2025 marked the onset of truly seismic changes to the global economic order. Yet whilst geopolitical developments have been anything but benign, UK property market returns data for the first quarter look exactly that. MSCI data show that in Q1, average commercial property asset values increased at an annualised rate of 2.5%, comfortably underwritten by annualised rental growth of circa 3.6%, slightly ahead of inflation in the wider economy.

The contrast with volatile equity and bond markets can rarely have been so stark. Of course, the picture is more nuanced than the headline data would suggest; property valuations lag real world developments, and the worst of the equity market volatility has occurred since the end of March. However, it raises the question of whether the real estate market can really buck the trend of volatility in both equity and bond markets.

The reality is that even the first order effects of the nascent trade war are hard to predict, and the real estate market is more likely to be impacted by second or third order effects.

|

Nonetheless, real estate has always occupied a space somewhere between equities and bonds, which may provide some protection in the current environment. A real estate investment should (in theory) deliver a combination of bond-like income streams, with the added potential of equity-like upside through rental growth. This upside is particularly useful in a world where investors are nervous about inflation.

Whilst very few real estate assets offer genuine inflation mitigation, many can be expected to deliver nominal income growth over time, giving them an advantage over bonds. Relative to equities, the largest proportion of real estate total returns come from contractual income streams, providing some insulation to fluctuating business confidence.

Of course, the real estate sector is not immune, as illustrated by the reduced pace of recovery since the start of the year. However, having already seen a significant value correction in 2022/23, it is arguable that real estate had more downside priced in at the start of this year than the two larger asset classes. |

|

Commercial property returns

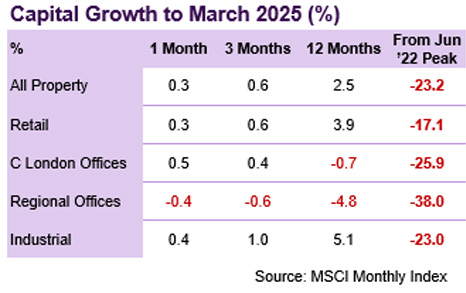

According to MSCI, average commercial property values increased by 0.3% in March, taking the cumulative recovery to 2.5% since this time last year. However, the trend rate of growth has halved, from 1.5% in Q4 last year to just 0.6% in the first quarter of ’25. Values are on average still 23.2% below their June ’22 peak.

Standard Industrial has been the leading sub-sector in the first quarter of 2025, with quarterly value growth of 1.0%, although this is less than half the rate recorded in the previous quarter (2.3%). Value growth has slowed even further for distribution warehouses, from 2.3% to 0.7%. Both sub-sectors continue to benefit from solid rental growth of circa 4% per annum.

Retail Parks were the strongest performing sub-sector over the last 12 months, with capital growth of 7.0%, but the quarterly growth rate has dropped from 2.5% in Q4 to 0.7% in Q1. Supermarkets bucked that slower trend, with capital growth increasing in Q1 relative to the previous quarter (1.0% vs 0.5%), turning annual growth positive for the first time since 2022.

The office market appears to be characterised by a divergence between Central London (values up 0.4% Q-on-Q), and the rest of the country (down 0.6% on average). Yet that simple picture masks more nuance, where the Outer South East (possibly driven by life sciences) is the strongest performer, whilst London City values remain soft. |

Investment market activity

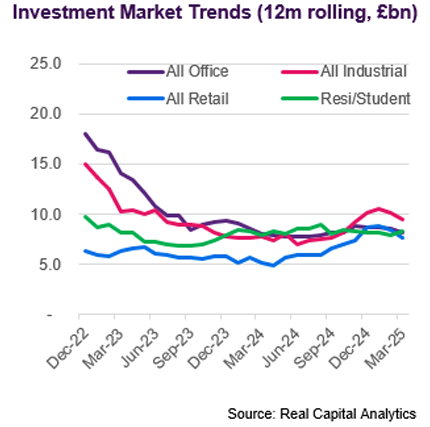

Preliminary data from Real Capital Analytics indicate that £2.4bn of transactions completed in March. Whilst this is a marked improvement on an exceptionally weak February (£1.3bn), it nonetheless continues to reflect a very slow market. The Q1 total of £6.7bn is around a third below the same periods in 2023 and 2024 and 70% down on Q1 2022.

The Living sectors bucked the trend to some extent, boosted by some notable multi-family transactions. In Leeds, Barings committed £152m to Glenbrook’s 618-unit Kirkstall Road scheme, the largest forward funding in the city to date. In Manchester, KKR acquired L&G’s Slate Yard scheme, comprising 424 units across 3 buildings, for £100m.

The largest transaction in mainstream commercial sectors was the sale by Lendlease of a 20% share in 21 Moorfields for c£148m. The partial interest in Deutsche Bank’s London HQ was acquired by Japanese investors at a price reflecting a total value of £740m at an initial yield of c5%.

A handful of other London office deals closed, including the sale by Angelo Gordon and Endurance Land of 25 Finsbury Circus for £72.5m. The asset, acquired by Malaysian developer IJM Corporation, is currently being redeveloped, with a pre-let agreed with law firm Simmons & Simmons

Barings and Rosethorn Capital agreed the largest student deal of the year so far, paying £101.4m for CLS Holdings’ Spring Mews scheme. The 378-bed scheme in Vauxhall was built in 2014 and includes a gym, swimming pool and cinema room. |

Market yields

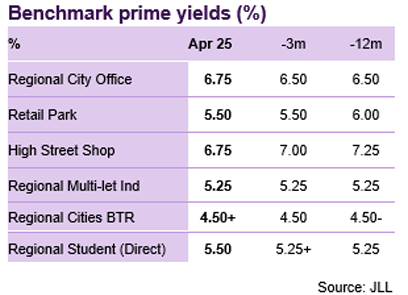

There has been dramatic bond yield volatility over the last month as the market has absorbed various announcements, clarifications, and revisions to US government policy on trade. However, the net result has been that the benchmark ten-year Gilt yield is slightly lower at the time of writing (4.55%) than it was a month earlier (4.72%).

Markets are now anticipating three further cuts to UK base rate this year, and as a result medium-term rates have also come in quite materially over the last month. The five-year SONIA swap was trading at 3.6% at the time of writing, down from 4.0% a month earlier.

JLL’s latest monthly report of market yields suggests that all mainstream commercial benchmarks have remained flat over the last month. The only change they’ve perceived is that the outlook for the largest City of London office assets (>£125m) has improved, and that prime yields for such assets are expected to come in from their current level of 5.75%.

There has also been very little change amongst living sectors, with the exception of elderly care, where JLL perceive that prime and “ultra-prime” yield benchmarks have softened by 25bp to 5.25% and 4.75% respectively. BTR benchmarks are perceived to be stable, within a very narrow range from 4.25% for prime London to 5.0% for secondary regional. PBSA benchmarks have a wider spread, from 4.5% to 7.25%. |

Auctions

Data from EIG illustrate a relatively slow start to the year for the auction market. Lots listed across the country in Q1 were down by 2.1% year-on-year, sales were down 3.4% and proceeds down by 4.3%. The sales rate was down at just under 70%, compared to perhaps 75-80% in a strong market.

Hesitancy amongst investors, and the difficulty of pricing assets, was illustrated in Allsop’s March auction. 106 lots were listed, yet barely half had sold by the end of the auction. At that point, proceeds of £33m compared to £75m raised from the March ’24 auction. However, since the auction, 13 more lots have sold, raising a further £10m. |

Market forecasts

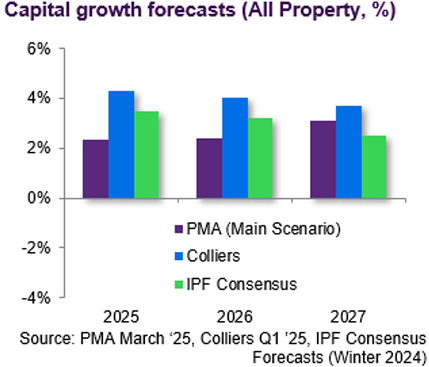

Independent forecaster PMA released their latest forecasts in March. Their main scenario is based on consensus economic forecasts of sluggish GDP growth (1.2% this year and 1.8% in 2026 & ‘27), moderately above target inflation and a gradual fall in base rate to 3.75% by 2026.

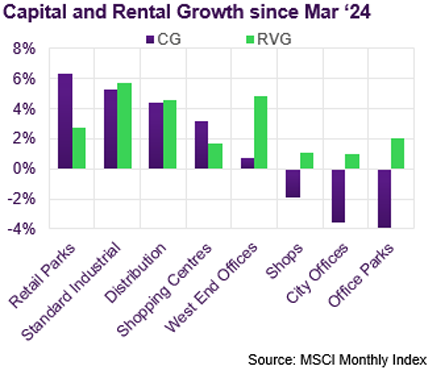

PMA anticipate that, on average, commercial property values will rise by 8% over a 3-year horizon (2025-27). However, they predict that Industrial will outperform, with capital growth of 14% over the same period. They expect this appreciation to be well underwritten by almost 11% of rental value growth.

Whilst Retail has been relatively resilient over the recent cyclical downturn, PMA predict that the sector will resume its previous position as sectoral underperformer, with cumulative capital growth of just 2.1% over 3 years. This relatively downbeat outlook comes despite their forecast of reasonably healthy rental value growth of 5.4% over the same period.

PMA’s forecast for the office sector is decidedly mixed, with capital growth of almost 11% expected in Central London, supported by rental growth of 12-15%. In contrast, a capital value decline of c11% is anticipated in West M25 markets, with no rental growth at all. Robust rental growth is forecast for the major regional Cities, but capital values are expected to drift sideways. |

|

Looking forward

The key driver of property values since 2022 has been the level of interest rates and expectations for their future path. One side-effect of current events is that markets are now expecting further cuts to base rate, manifesting in materially lower medium-term swaps. At the time of writing, a five-year SONIA swap was trading at around 3.6%, so hedging can once again help to reduce interest cover constraints for investors seeking moderate leverage. The domestic risk-free rate has also settled down after a bout of volatility, bringing hurdle returns back to achievable levels.

In parts of the property market, notably residential and industrial, the yield spread between prime and secondary assets has become compressed as interest rates rose. It seems likely that as rates pressure is reduced, higher quality assets will benefit quite quickly, but that this will not necessarily spread into higher yielding assets. In the office and retail sectors this spread has been significantly wider and may now become wider still. With signs of competitive tension returning for the strongest office and retail assets, occupiers with expansion plans may have little option but to press ahead there, whereas the temptation to delay will be far stronger where that pressure is absent.

It would be a serious stretch to claim that even prime real estate is a safe haven. That status has clearly been bestowed upon gold, which saw a 30% rise as investors fled other assets classes. However, as a real asset, property shares a key characteristic with the yellow metal, and comes with the added inducement of an income return whilst you wait. Property investment may not be “as good as gold”, but the adage “as safe as houses” illustrates the enduring value of well-located real estate with broad-based demand. |

Visit us

Discover a wealth of

real estate expertise, regardless of your business level or stage.

Property Perspectives: A NatWest Commercial Real Estate Podcast

Our new podcast series explores the latest trends, innovations, and sustainability practices shaping the commercial real estate industry.

Find the latest episodes on Business Insights Property perspectives: A NatWest Commercial Real Estate podcast |

|

|

If you would like to opt out, please get in touch with your Relationship Manager.

This document has been prepared by National Westminster Bank Plc or an affiliated entity (“NatWest”) exclusively for internal consideration by the recipient (the “Recipient” or “you”) for information purposes only. This document is incomplete without reference to, and should be viewed solely in conjunction with, any oral briefing provided by NatWest. NatWest and its affiliates, connected companies, employees or clients may have an interest in financial instruments of the type described in this document and/or in related financial instruments. Such interests may include dealing in, trading, holding or acting as market-maker in such instruments and may include providing banking, credit and other financial services to any company or issuer of securities or financial instruments referred to herein. NatWest is not and shall not be obliged to update or correct any information contained in this document. This document is provided for discussion purposes only and its content should not be treated as advice of any kind. This document does not constitute an offer or invitation to enter into any engagement or transaction or an offer or invitation for the sale, purchase, exchange or transfer of any securities or a recommendation to enter into any transaction, and is not intended to form the basis of any investment decision. This material does not take into account the particular investment objectives, financial conditions, or needs of individual clients. NatWest will not act and has not acted as your legal, tax, regulatory, accounting or investment adviser; nor does NatWest owe any fiduciary duties to you in connection with this, and/or any related transaction and no reliance may be placed on NatWest for investment advice or recommendations of any sort. Neither this document nor our analyses are, nor purport to be, appraisals or valuations of the assets, securities or business(es) of the Recipient or any transaction counterparty. NatWest makes no representation, warranty, undertaking or assurance of any kind (express or implied) with respect to the adequacy, accuracy, completeness or reasonableness of this document, and disclaims all liability for any use you, your affiliates, connected companies, employees, or your advisers make of it. Any views expressed in this document (including statements or forecasts) constitute the judgment of NatWest as of the date given and are subject to change without notice. NatWest does not undertake to update this document or determine the accuracy or reasonableness of information or assumptions contained herein. NatWest accepts no liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this material or reliance on the information contained herein. However, this shall not restrict, exclude or limit any duty or liability to any person under any applicable laws or regulations of any jurisdiction which may not be lawfully disclaimed. The information in this document is confidential and proprietary to NatWest and is intended for use only by you and should not be reproduced, distributed or disclosed (in whole or in part) to any other person without our prior written consent.

National Westminster Bank Plc. Registered in England & Wales No. 929027. Registered Office: 250 Bishopsgate, London EC2M 4AA. National Westminster Bank Plc is authorised by the Prudential Regulation Authority, and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

|

|

|