Human rights

Human rights and nature are interconnected, as the protection of the environment is essential for securing fundamental rights such as access to clean air and water, as well as the rights of communities and indigenous peoples to their lands and resources. We have an important role in promoting respect for human rights and a strong desire to maximise any positive impacts and mitigate, where possible, any potential negative impacts that our activity and the activity in our value chain may have on society. Our approach is informed and guided by The United Nations Guiding Principles on Business and Human Rights, and we have identified salient human rights issues for NatWest Group which include Land Rights and Contribution to Climate Change. More detail on our approach and how we manage our salient human rights issues can be found at Human rights and modern slavery page.

Environmental Social and Ethical Risk

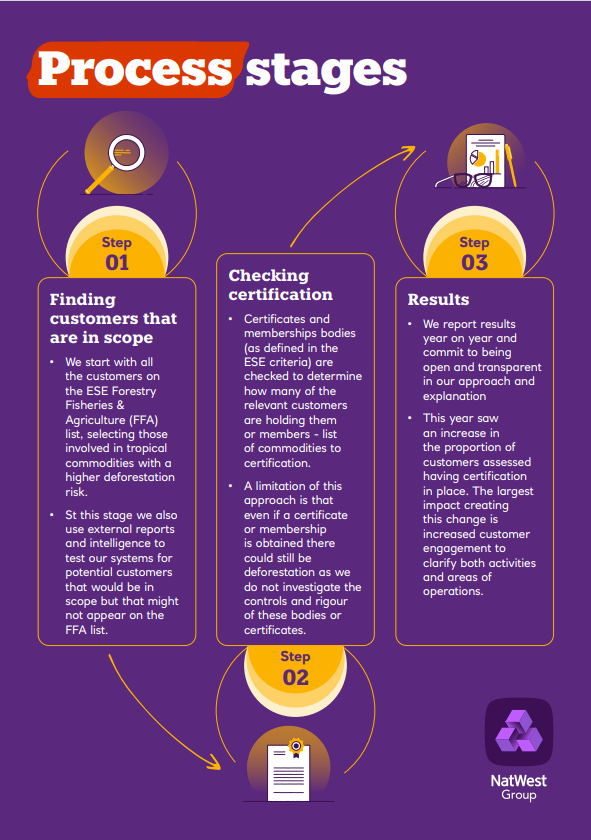

NatWest Group’s ESE risk framework has been in place since 2011 and is updated on a regular basis it forms part of the bank’s reputational risk framework, intended to protect the bank’s reputation. We have integrated the DRC specified certifications into the FFA ESE policy criteria, which prohibits soft/ deforestation risk specified commodities producers operating in tropical regions who have not obtained sustainable certification of their direct DRC activities

NatWest Group’s ESE risk acceptance criteria sets our position on what activities and customers we prohibit ourselves from onboarding. These apply to the onboarding of non-personal customers (including, but not limited to, for the purposes of providing lending or loan underwriting services). Furthermore, they set out restricted activities upon which we conduct enhanced due diligence. These include risk acceptance criteria for sectors and topics including but not limited to; Human Rights, Forestry, Fisheries and Agribusiness, Mining and Metals, Animal Welfare and Power Generation.

We are signatories to the Equator Principles which is a voluntary framework adopted by financial institutions to help determine, assess and monitor environmental and social risks associated with project finance. These have been integrated into our ESE risk framework, including for Forestry, Fisheries and Agribusiness (FFA). For more details, please refer to the FFA policy through the link below.